Curb Inflation with a Temporary Buydown

WHAT YOU'LL LEARN

What is a temporary buydown?

Why temporary buydowns are great during inflation

How to save and prepare to refinance later

WHAT YOU'LL LEARN

What is a temporary buydown?

Why temporary buydowns are great during inflation

How to save and prepare to refinance later

When inflation makes basic daily purchases difficult, it certainly affects home prices as well. But a tough market doesn’t mean you have to wait for rates to go down. A temporary buydown might be your ticket to homeownership!

What Is a Temporary Buydown?

A temporary buydown gives you the option to reduce your interest rate on a loan for up to two years (by no more than 1% per year). The lender, seller, or builder pays an upfront cost at closing that saves you money by reducing your principal and interest payments during the buydown period. With any luck, you can get your seller to pay the cost of your buydown through seller contributions.

Temporary buydowns are different than the permanent buydown you get from paying “discount points.” Borrowers can pay for these points as a one-time fee at closing to buy down your rate for the life of your loan. Each mortgage point is based off a percentage of the total loan amount.

However, paying discount points during high inflation may not be as effective for you as a temporary buydown. Ask us for help while deciding what’s best for you. You may want to also ask about other resources like gift funds and down payment assistance programs.

2/1 and 1/0 Buydowns

A 2/1 buydown means you pay an interest rate reduced by 2% in the first year and 1% in the second year. This allows you to save money or have time to advance in your job so you can afford higher payments when the buydown period ends. Let’s look at how it breaks down:

Original interest rate: 7%

Year 1: The rate is 2% lower = 5%

Year 2: The rate is 1% lower = 6%

Year 3 until term: The rate is 7%

Similarly, a 1/0 buydown reduces interest by 1% during the first year only.

See the Savings

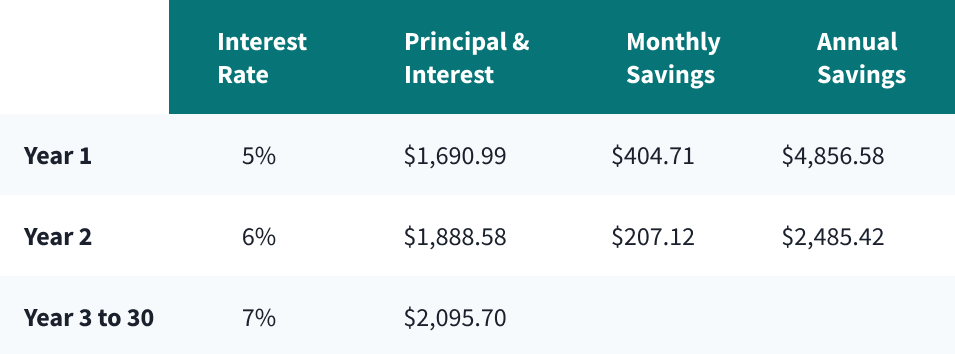

For illustration purposes only, here are the savings from on a sample 2/1 buydown:

$350,000 purchase price, 10% down payment, 7% interest rate

Your total savings are $7,342.00! But remember that your payments will increase as the buydown period comes to an end. So, keep those savings, maintain good credit, and work toward being able to manage that higher mortgage payment—with hopes of refinancing when rates get better. Speaking of…

Temporary buydowns are for fixed-rate purchases of primary residences only, but they are available for all loan programs: Conventional, FHA, VA, and USDA. *Ready to enjoy lower payments for a couple of years while you save? A temporary buydown may be right for you! Call us today to learn more!

*USDA does not allow 1/0 buydowns. Buyers are not allowed to pay the buydown subsidy. For VA loans, the seller must provide the full cost of the buydown.