6 Mortgage Tips You Should Know as a First-Time Homebuyer

Thinking about buying your first home? Congrats! Taking the leap into homeownership is an experience like no other – and it’s also a smart investment for the future. But, it doesn’t come without lots of planning and decision-making – and that’s a good thing. When it comes to obtaining your first mortgage, here are the top considerations you should make.

1. Choose the right lender

Buying a home is a big investment, arguably one of the largest that most people will make in their lifetime. That’s why it’s so important to choose a great lender to help walk you through the home purchasing process. Pay attention to things like closing time averages and customer satisfaction rates. Make sure your lender is not only the right financial fit, but also the right personal fit.

2. Determine how much you're comfortable spending

Making such a large investment will require a significant amount of thinking – or at least, it should. There are many factors to consider, from the type of mortgage to interest rates, down payments and more.

There are a variety of mortgage options, and the one you choose might impact how much you're willing to spend overall on a new home since interest rates, down payments and monthly mortgage amounts are based on the type of mortgage you obtain.

Total Amount Borrowed

When you work with a lender to determine how much home you can afford, sometimes you’ll be surprised at the dollar amount he or she presents to you. For example, going into the home buying process for the first time, my spouse and I had a certain home price we felt comfortable with and that we felt we would qualify for. When our lender told us the amount we were approved for, it was actually $100,000 greater than we were even considering, And while it felt nice to know that, we didn’t want to become ‘house poor’ simply because we could technically afford to buy a bigger, nicer home.

It’s always important to carefully consider how much you’re willing to spend and don’t become blinded by numbers. When budgeting, the 50/20/3o rule is a good starting point. It states that you should allocate 50% of your income toward recurring payments (i.e. bills you consistently pay), 30% toward flexible spending, and 20% toward saving.

Down Payment

Many first-time homebuyers don’t come to the table with a lot of extra cash lying around, but fortunately there are mortgage options that don’t require a significant down payment. It’s important to discuss with your lender how much you feel comfortable shelling out, since that can impact the type of loan and overall home price you go with.

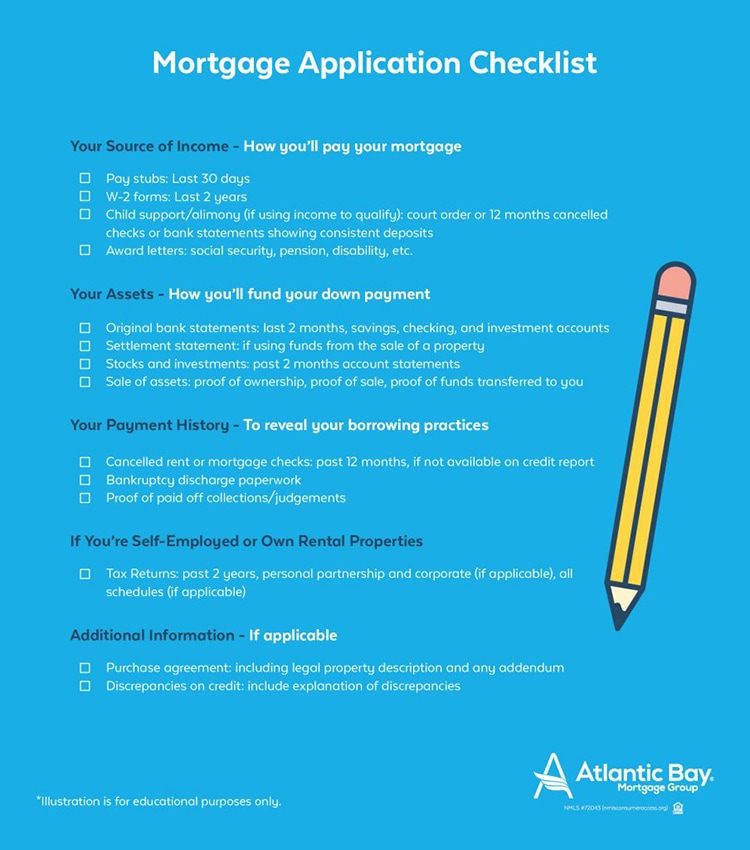

3. Have your documentation ready

Buying a home can be a very competitive venture, depending on the current real estate market. That’s why it’s so important to have your ducks in a row before starting your home search. After all, you don’t want to find the home of your dreams and not be able to put an offer because you haven’t met with a lender yet to become pre-approved. In a very hot market, some listing agents will only allow qualified and serious buyers to attend showings.

4. Find the bets real estate team

Having a great real estate agent in your corner also provides an advantage throughout the home buying process. When we purchased our most recent home, we chose to work with an agent who has an excellent reputation, grew up in the area and is familiar with all of the surrounding areas – and he was extremely personable to boot. His expertise and honesty were both key in helping us make a smart purchase decision – one that should pay off down the road when we decide to sell the home.

5. Freeze your spending

A good lender will likely remind you of this fact, but it’s so important to put a halt to large spending when you’re in the process of obtaining a mortgage.

Avoid taking out new lines of credit. It’s not a good time to finance a new car or apply for a credit card (yes, even if it’s for your favorite store.).

Don’t let your credit card balances grow. Your lender will calculate your debt-to-income (DTI) ratio as part of the pre-qualification process, but will continue to keep tabs on this number up until closing day. You don’t want to find out at the last minute that your DTI went over the limit and you’re no longer able to purchase the home.

It’s also best practice to save any large purchases for after closing day – even if the money is coming directly out of your bank account, since your total financial picture will be viewed when obtaining a mortgage.

6. Take your time

You’ve met with a lender, selected a real estate agent, and you’re ready to start looking at homes – now’s the fun part. It’s easy to get caught up in the home search and to feel like you need to make a decision ASAP, especially when you see homes around you selling like crazy. The smartest thing you can do for yourself is take your time and ensure you make an educated and well thought-out decision – after all, you’re making what will likely be a long-term investment. If you have any questions about the mortgage process or you’re ready to dive in, talk with your mortgage banker.